Colorado Private Car Sales Tax

On and after January 1 2019 the bill exempts a motor vehicle from state sales and use tax if. Colorado offers one of the lowest car sales taxes in the country aside from the tax-free states.

How Colorado Taxes Work Auto Dealers Dealr Tax

The taxable value of the motor vehicle is twenty thousand dollars or less.

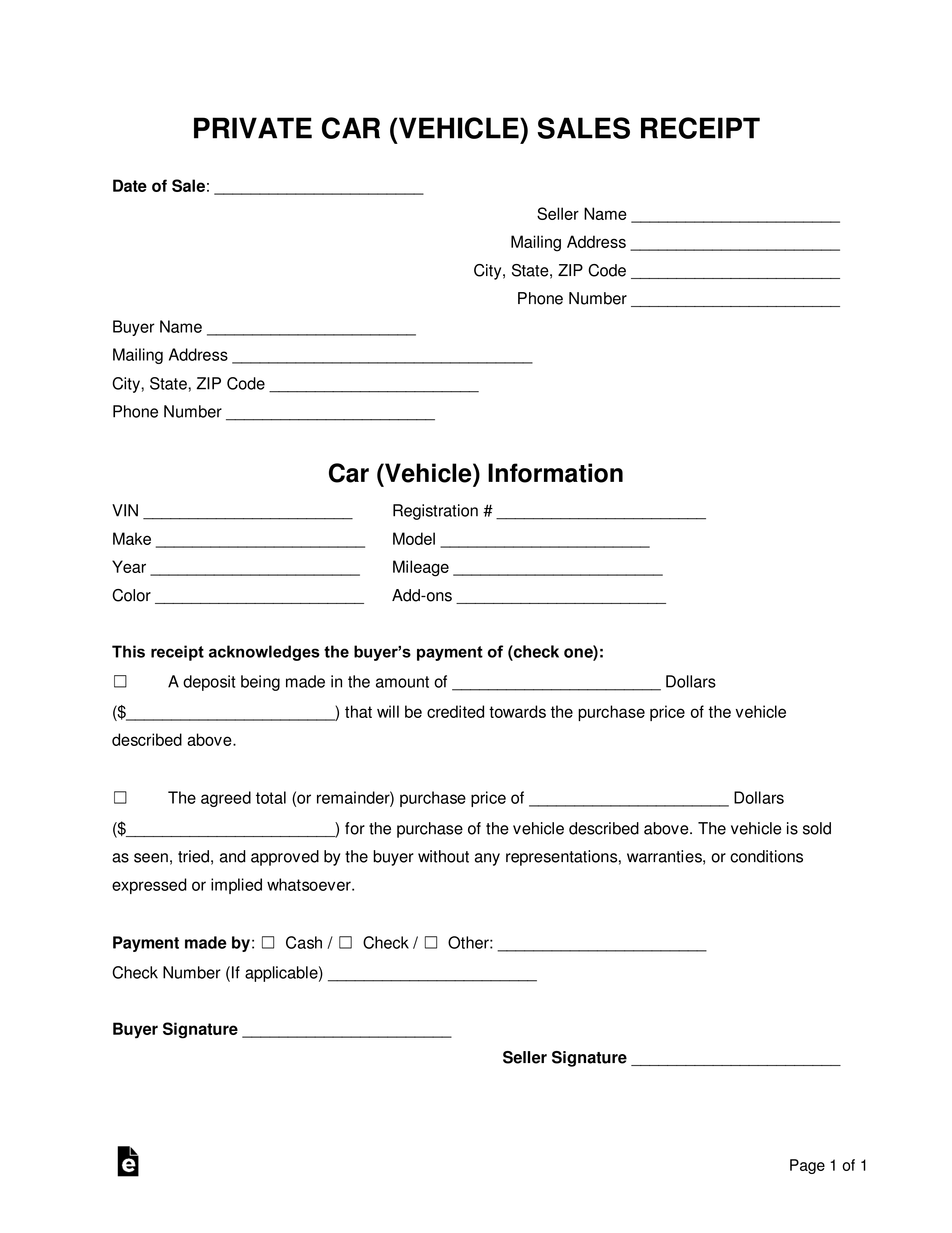

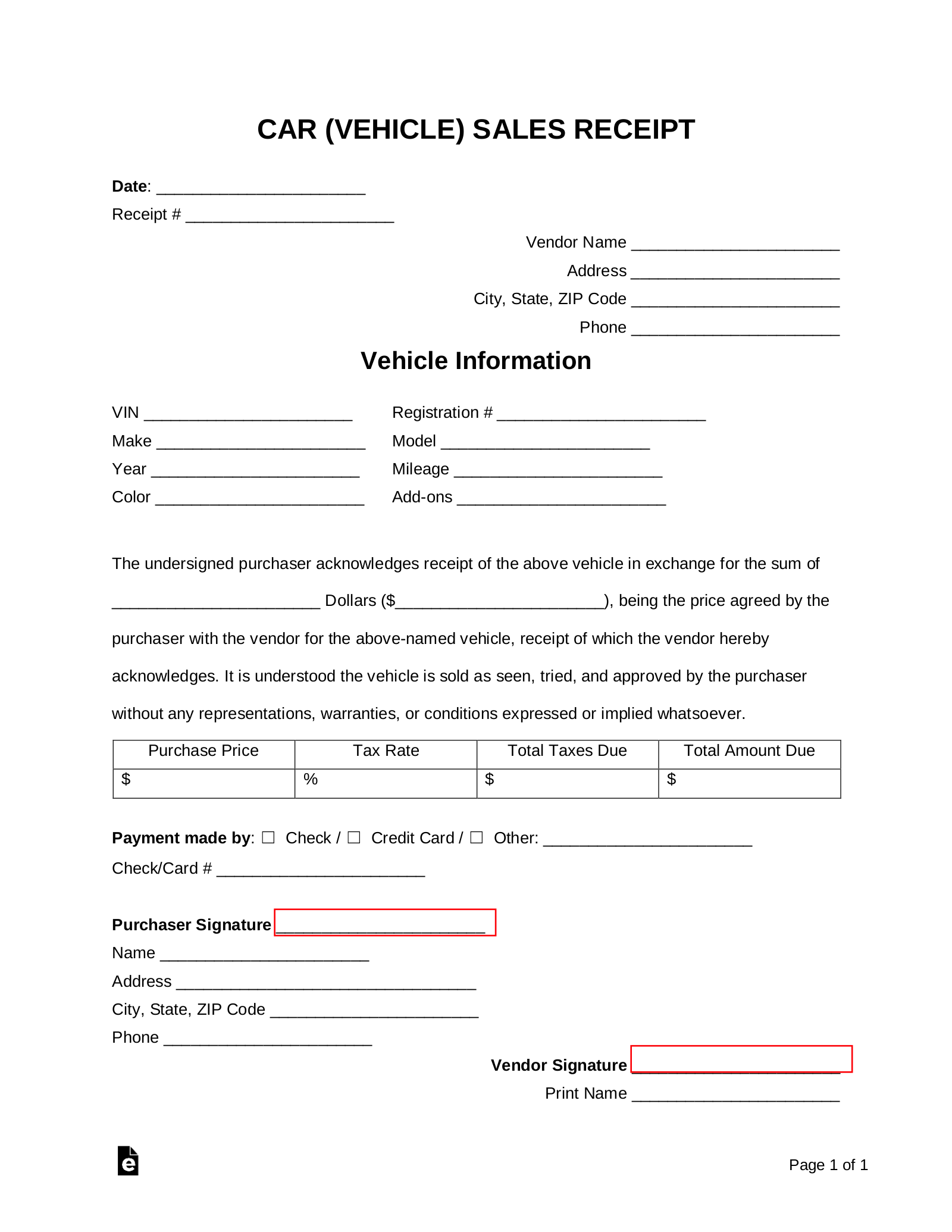

Colorado private car sales tax. You may now Register your Vehicle Online or Schedule an Appointment. However a county tax of up to 5 and a city or local tax of up to 8 can also be applicable in addition to the state sales tax. Make sure to include vital information like buyer name the vehicle purchase price for sales tax purposes VIN make model and year and your signature.

The maximum tax that can be owed is 525 dollars. DR 0100 - Learn how to fill out the Retail Sales Tax Return DR 0100. The state guidelines sellers and buyers must follow help ensure the.

Tax obligation when you buy a car through a private sale. In Colorado car buyers are only paying a 29 tax plus the county city and district taxes. The vehicle was purchased either on a Saturday on a Sunday.

42-3-115 2 b CRS. Provide a current emissions certificate. If your car is less than 10 years old you need to obtain an odometer disclosure.

As of 2020 New York has a car tax rate of 4 percent plus local taxes whereas next-door neighbor Massachusetts has a state car tax rate of 625 percent with some local rates much higher. You can review the car tax rate by state to see what other areas charge. The buyer has purchased the motor vehicle within the last 36 hours from a person who is not a licensed motor vehicle dealer.

In general the tax does not apply to sales of services except for those services specifically taxed by law. A certificate of title has previously been issued in the state for the motor vehicle. Provide a Bill of Sale DR 2173.

Fees are based on the empty weight and type of vehicle being registered CRS. When you buy a vehicle from a private party you need to make sure you receive everything that the state of Colorado requires a seller to provide. Colorado legislation on private-party used-car sales is intended to benefit both the seller and the buyer.

Sign over your title to the buyer. 42-3-306 Additional fees may be collected based on county of residence and license plate selected. Walk-in service is available Monday-Friday 800 AM 430 PM at our Castle Rock.

DR 0800 - Use the DR 0800 to look up local jurisdiction codes. Knowing how much sales tax to pay when purchasing a vehicle is also helpful to know when asking for financing from a lender. Handing over the Certificate of Title with the name of the sellers signed and printed.

The exemption does not apply to any other. Use tax applies to the sale of vehicles vessels and aircraft purchased from non-dealers for example private parties or from outside California for use in this state. When you purchase a vehicle through a private sale you must pay the associated local and state taxes.

California sales tax generally applies to the sale of vehicles vessels and aircraft in this state from a registered dealer. Because of the different cities and taxing jurisdictions within Larimer county the sales tax rates will vary. Background - Understand the importance of properly completing the DR 0024 form.

Putting this all together the total sales tax paid by Colorado. Does Colorado Charge a. Prior to registering a vehicle in Colorado Proof of Insurance for the vehicle you are registering is required.

The seller is responsible for. Sales Tax for Vehicle Sales DR 0024 Form After completing this course you will be able to do the following. Sales Tax Calculation.

After Hours Purchase CRS. This is only for vehicles that have a Colorado title were paid for in full and were purchased by a. Of course if you are in the car sales business youll want to report your income taxes capital gains taxes and business taxes appropriately to avoid issues with the IRS.

Buying From a Private Party. The amount due is a percentage of the purchase price and is based on the taxing jurisdiction of the buyer and seller. Fiscal Policy Taxes.

Sales Tax Rates Sales taxes are due one time after a new or used vehicle purchase at the time your vehicle is titled. If you live within the boundaries of the Pikes Peak Rural Transportation Authority that entity collects a 1 percent sales tax. Instructions for Private Party Colorado Title Transfer This is a guide to assist individuals who have conducted private party vehicle sales during the COVID-19 pandemic.

A buyer of a vehicle may operate a vehicle on the highway prior to registering the vehicle when. Colorado imposes sales tax on retail sales of tangible personal property. Colorado collects a 29 state sales tax rate on the purchase of all vehicles.

However in the case of a mixed transaction that involves a bundled sale of both tangible personal property and service whether or not such service is specifically taxed the entire purchase price may be.

Nj Car Sales Tax Everything You Need To Know

How To Start A Car Dealership Truic

2021 Arizona Car Sales Tax Calculator Valley Chevy

What S The Car Sales Tax In Each State Find The Best Car Price

Free Vehicle Private Sale Receipt Template Pdf Word Eforms

Many People Want To Buy A New Car Just Because Of Less Cash They Will Think To Go For A Car Loan But They Don T Have Idea How Car Loans

Best And Worst Months To Buy A Used Car According To Data

How Colorado Taxes Work Auto Dealers Dealr Tax

Car Dealerships Are Dealers Equipped Enough To Adapt To The Changing Paradigms Of Car Sales Auto News Et Auto

Can I Avoid Paying Sales Taxes On Used Cars Phil Long Dealerships

How Colorado Taxes Work Auto Dealers Dealr Tax

Car Tax By State Usa Manual Car Sales Tax Calculator

Virginia Sales Tax On Cars Everything You Need To Know

Louisiana Car Sales Tax Everything You Need To Know

How To Legally Avoid Car Sales Tax By Matthew Cheung Medium

Post a Comment for "Colorado Private Car Sales Tax"